International Accounting, Controlling and Taxation (IACT) – MSc

Management career in controlling and finance

In the International Accounting, Controlling and Taxation degree programme, you will deepen your knowledge of the fundamentals of business administration and acquire additional specialist knowledge in the areas of international accounting, international controlling, taxation and finance.

Goal-oriented Education

After graduating, you will be ideally prepared for a management career in accounting, taxation, finance and controlling.International Focus

The focus on global business relations is a common thread running through all the subjects.Learning and Doing

Academically sound and highly application-oriented.

Key Data

All the facts and figures for your degree programme at a glance

Duration of studies

Admission requirements

Language of instruction

Start of studies

Costs

Study places

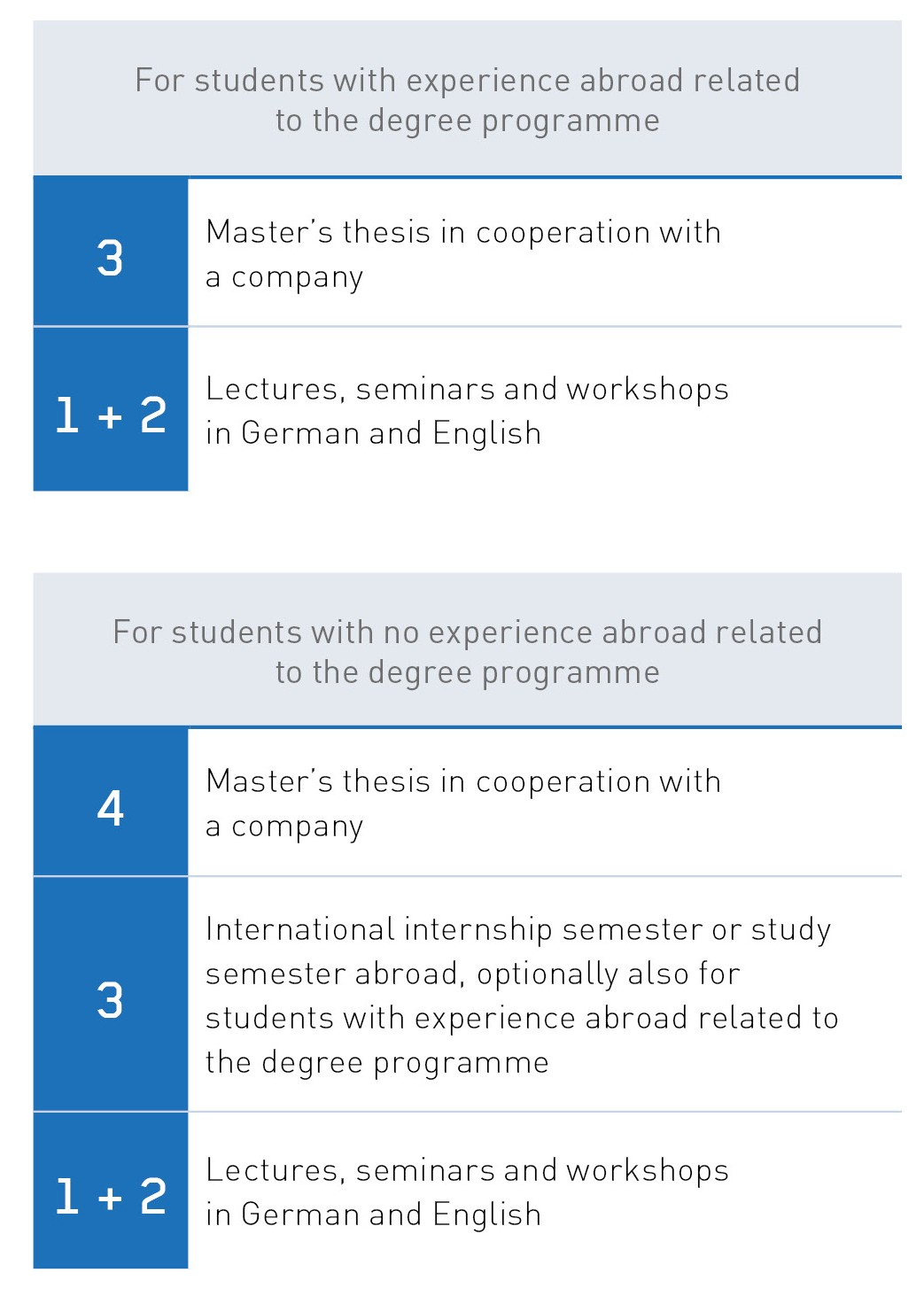

An international career in three semesters

In this degree programme, you will learn how to adapt companies to changing conditions, implement efficient controlling instruments and master challenges in international accounting and taxation.

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/8/3/csm_Martina_Traub_Kaiser2_7de99e10c8.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/7/6/csm_AR-Siegel_System_RGB_transparent_f4c7bf0be6.png)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/8/b/csm_siegel_che_ranking_2025_401x600_7704ddaee3.jpg)